Hello.

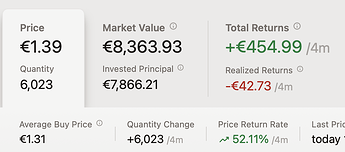

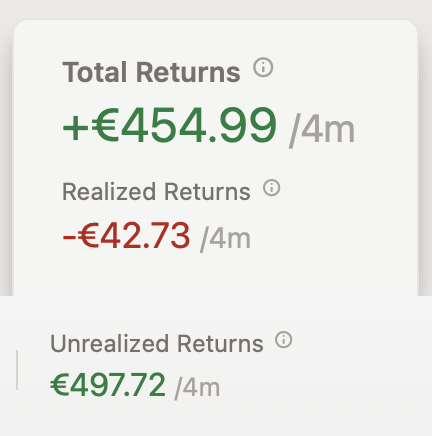

I have a situation. I entered some transactions all seems ok, I have this market value, realised returns and total returns:

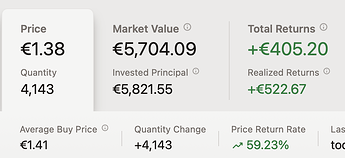

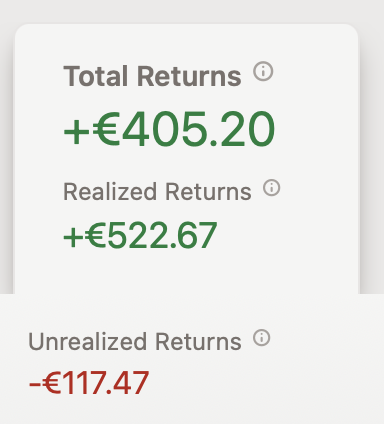

then I entered some sell transactions, and something very wired is happening. the numbers look like this:

What happened:

- Average buy price increased

- Realised return is greater that total return

- Unrealised return became negative

- Realised return is calculated with profit from the first transactions, not from average buy price

This is an issue from the tax perspective, because every tax is applied to actual realised profit which is (actual price x sold quantity) - (average price x sold quantity). every broker and authority calculates the same, so there will be discrepancies between app returns and the real ones

So in my example, instead of having realised return ~150E and unrealised return of ~250E (which is the correct version) , I have realised return of ~500E and unrealised return of ~ -100E, which is not true even id the overall total is the same.

I find it useful to see the profit per transaction (in the table), looking at the first transactions, but the totals from the top should be calculated in relation with the average buy price.