Hi!

It’s tax season and I’m trying to use Capitally’s Tax Due report to help me with my declaration ![]()

One issue is have is related to the currency exchange date chosen for a given transaction. I saw some relatively fresh threads about the support for settlement date and I have T+settlement-1 set in my tax preset, but in one case something is not working correctly for me:

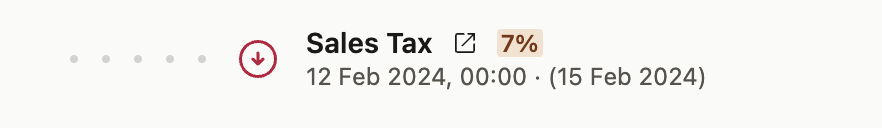

I assume that the date in the parentheses is the settlement date, as I haven’t found any documentation for that (some tooltip would be nice!). The weird thing is that it’s scheduled 3 days after the transaction date. It doesn’t seem to be a business day thing, as Feb 12th 2024 was a Monday. Interestingly, the date seems to be calculated correctly for other transactions that I have (Apr 1st → Apr 3rd and Jun 12th → Jun 13th, as on May 28th it was changed from T+2 to T+1).

The settlement date affects the currency date, which is also one day too late.

Am I missing something?

Thanks!