Hi Rafal,

As you know, the US automatically withholds taxes on dividends if you’re a foreigner; the tax is 15% if you live in Canada.

Now, through tax presets, I can account for that 15% as “tax due” and can see my returns accounting for that withholding by setting “Include taxes: Due” in the return calculation options, and looking at “Total a-tax returns”. If I look at “Investment income” under “Lots”, it also accounts for that tax.

My problem is with automatic cash tracking, where it does NOT account for the tax that was withheld but shows the entire amount (no tax) hitting my cash account.

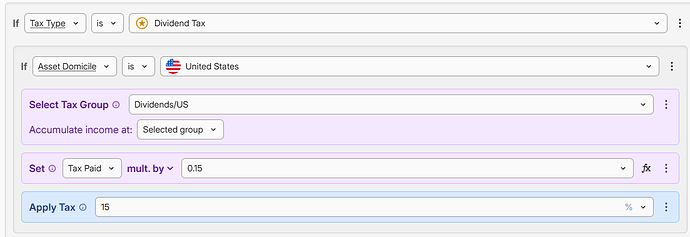

I tried playing with my tax preset and force setting the “Tax Paid” field to 15% of the dividend amount, as you can see below, but it doesn’t change anything. I’ve also tried setting the field to an arbitrary value, but it doesn’t work either.

How can I achieve what I’m looking for?

Many thanks,

Francois