Hi,

If I have a tax preset with the currency exchange rate date offset set to “D+1”, then it should be computed as the next working day according to the holidays calendar of the tax residence country.

An example:

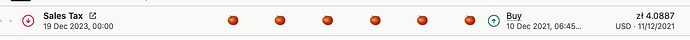

- Asset bought on 10 Dec 2021 (Friday). Offset set to D+1.

- Currently, the tax display shows currency date 11 Dec 2021 (Saturday), and rate from 10 Dec 2021 (Friday).

- Expected: the tax display shows and uses the currency date and rate from 13 Dec 2021 (Monday).

Tables published by the Polish central bank don’t include rates for non-working days. If other supported countries are alike, maintaining a holidays calendar per country may not be necessary.